What is a wire transfer wire? Is wire transfer a way to transfer international money? Is wire transfer the best way to transfer currency between different countries in the world? In this article, we will review Wise Transfer and its wire transfer services, and in general, we will teach you how to transfer international currency wires.

If you need to send or receive money fast, wire transfer money can be a good tool for work. Fastwire Transfer is reliable and generally safe, and for significant transactions – such as buying a home – money transfers or cashier’s checks may be your only option as the funds are more or less immediately available to the recipient. Learn the tricks of money transfer Fast money transfer

What is a wire transfer?

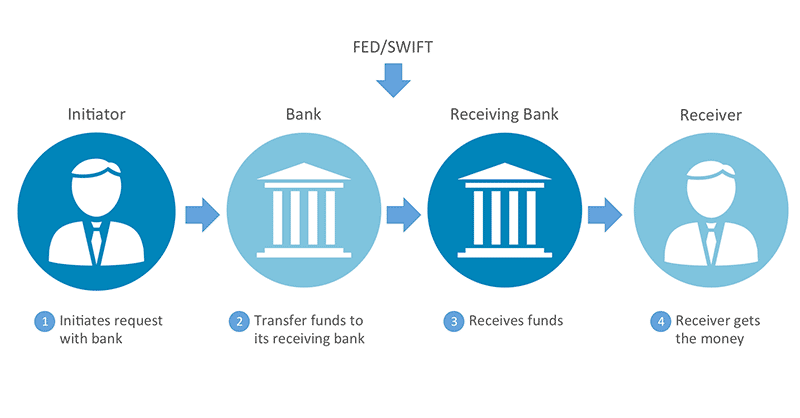

Wire Transfer Describes any electronic money transfer. Usually, if someone requests a “wire transfer”, they want a traditional bank transfer to the bank. A traditional wire transfer from one bank to another using a network such as the Worldwide Interbank Financial Communication Association (SWIFT) or FedWire

But the term wire transfer applies to other types of transfers. For example, American consumers can also make money to overseas individuals through international transfers, also known as remittances, in addition to banks, credit unions, and other service companies. Finance can act as a money transfer provider in these transactions. That’s why it’s important to clarify the situation if someone requests wire transfer

Wire transfer fee

Wire bank transfers, unlike some electronic payments, cost – from $ 15 to $ 50 per transfer. This cost depends on the bank, whether the outgoing or incoming wire is domestic or international, and the amount of the transfer. In general, domestic input wires are at the lower end of this price range, while international output wires are the most expensive. In addition, some banks waive internal entry fees for certain types of accounts

Wire transfer speed

Wire transfers are useful because they reach their destination faster than other methods in terms of time.

It only takes a few minutes to set up and transfer the wire transfer. In the United States, transfers can take place on the same day, depending on when your application was filed. International transfer does not take more than one or two days. Because the money moves quickly, the recipient does not have to look for proof of sending or receiving money, and security problems are rare.

However, it may take several hours for the receiving bank to show wire income in the recipient’s account – even if the money is in that bank. A bank employee may need to do several things to make funds available. For anyone selling goods or services, a wire transfer is less risky than a check because the sender must already have enough funds in their account to start the wire transfer. In contrast, checks can be problematic and it may take several weeks for an international check to be paid. Even so, owning one is still beyond the reach of the average person.

Wire transfer security

The main risks of money transfer are also related to wire transfer. With a wire transfer, money goes from one bank to another and then to the recipient’s account. In the United States, each transferor needs a bank account. To open an account, federal regulations require banks to verify your identity (among other things) and ask you to find a physical address.

This lack of identity when doing banking limits the ability of thieves to catch scams with bank transfers to some extent. However, if you pay money to a stranger or through paid businesses (such as a “money transfer” retail store in a bar, Western Union, or equivalent), confirm what It is more difficult for someone to receive this money. Personal money with a fake ID can collect cash, and many potential fundraising sites may make it difficult to track the recipient. That’s why sending money is only important for trusted people or businesses

Avoid scams

Advance payment, closing fees and other wire transfers to a reputable company or a real estate specialist is an attractive target for hackers. When buying a home, always check where the transferred wire transfer is – especially if you receive instructions via email. Hackers can modify emails (even those you’ve worked with for weeks) and instruct you to send money to the wrong place. To avoid problems, contact the receiver to confirm the wire instructions. Likewise, do not share your financial information in emails or open anonymous email attachments

Receive funds

Receiving money through wire transfer is safe in most cases. Payments are more secure because banks only deposit money if they have the sender’s money. In addition, money transfer providers make it difficult for the sender to get back after the money transfer. However, some wires (for example, international currency transfer wires) can be reversed in certain circumstances. Thieves may promise to send money wirelessly, but in fact send money using a different (reversible) method to confuse the customer. Only selling to reliable buyers can help you avoid this scenario

Other types of electronic transmission

The term “wire transfer” is often used for various electronic transfers that are not necessarily the same as instant or secure bank transfers, as described above. In fact, most payments are electronic (even digital checks are included). These transfers are an option when you can not or do not want to send a wireless transfer

Money transfer services

Financial services companies such as Western Union or Transfer Wise operate independently – you can bring cash for face-to-face transfers and the recipient logs out with cash. The transfer can take up to five business days. The recipient is identified by personal information such as his name and address

ECH Transfers

These are bank-to-bank transfers via the ACH Automatic Liquidation House network. ECH transfers usually take one to two days. These transfers are reversible, but only in limited circumstances.

PPP payment tool

These person-to-person services are usually easy and inexpensive and include Venmo, Zell and PopMoney. Each tool has a different time frame for transfer (for example, PopMoney allows a standard three-day transfer from bank accounts). They also have different strengths and weaknesses, so users should study individual service options. Find out which one is best for money exchanges, refunds and other transfers

What is Wise Transfer?

Wise Transfer is an online account project that allows you to wirelessly transfer currency, receive money, and spend money internationally. With a Wise Transfer Account, you can send money abroad, receive money in other currencies, and spend Wise Transfer Debt abroad with a MasterCard.

You must get confirmation to open a currency account in Wise Transfer

Creating a multi-currency account with Wise Transfer opens up the full range of features available to customers. This means that you will be able to: keep more than 50 currencies in your account, transfer currencies to your account immediately with low fees, get banking information Get free currencies, pay direct debts in pounds And adjust the euro

Order a Wise Transfer Cash Card (currently in Europe, USA, Australia, New Zealand and Singapore), spend on a cash card with any currency at a low cost, you must be confirmed to open your multi-currency account, usually with Some photo ID, proof of address and / or image of that ID you have. It usually takes about 2 business days. Log in to your account and follow the setup steps

Wise transfer is safe and fast

Since its first transfer in 2011, it has helped more than 6 million people send money to more than 70 countries. To do business in all the countries in which they operate, they must be certified by several financial authorities around the world. Transfer Wise uses HTTP encryption and 2-step login to transfer currency wire and to protect all your transactions and ensure the security of your communications. This company will never misuse your information

How can I send money by Wise transfer?

First, register in Wise Transfer for Currency Wire Transfer. Your email address will be prompted and you will generate a password. You can also sign in by connecting to your Google or Facebook account. Note: If you already have a Transfer Wise account, go to the home page on the website and select the Money Transfer option, or tap Send on the app to set the transfer, type the amount you want to transfer. , You can start with the amount you want to send or the amount you want your recipient to receive

Note: If it is important that your recipient receives the exact amount, receive that amount in the recipient box. Wise Transfer automatically tells you how much to send. Then specify the transfer type. If you are paying from a personal bank account, this is a personal transfer. You can also find out more about business transfers on the Wizz Transfer website by filling out your details. Wise Transfer will ask for your personal information, such as your address. They need this information to comply with financial regulations and will never share it

Destination recipient

Who are you sending money to? , If you have their bank details, add them and this company will send the money to that account. Otherwise, uncheck the box – an email will be sent to your recipient asking them to see confirmation of the transfer, then review your transfer details. Make sure everything looks right. You can add a reference to your recipient if you wish

Choose the type of transfer and payment method. You will be notified of the costs of each option and how long it will take for the money to arrive. Note: Payment from your bank account is usually low cost. This means that you have to go to online banking or your branch and then send the money for Wise transfer. After receiving your money, the transfer will be confirmed via email or in-app. They will also let you and your recipient know when the money arrives

Multi-currency accounts in Wire Transfer What is Wise Transfer?

A Transfer Wise multi-currency account lets you keep money in more than 50 currencies and exchange between them at the actual exchange rate whenever you need to. Registration is free and there is no subscription fee. You can also get banking information of other world currencies. Share these details with your friends, companies or customers to receive money from around the world

You can transfer money from your account to a bank account whenever you want. Transfer Wise will receive a fixed fee when you do this and a conversion fee when you transfer to another currency, or, spend the currencies in your account worldwide with Wizard Transfer MasterCard. Receive low conversion costs and zero transaction fees, but you should see if the Wise Transfer Debt Card is available in your country.

Use Wise Transfer to start an international business

Wise Transfer for Business is a free online multi-currency account. Allows you to pay, receive and spend money at real world exchange rates. You can also use it to pay invoices, purchase inventory and payroll in more than 70 countries – up to 14 times cheaper than PayPal

Opening an account is quick, easy and free.

Setting up a Wise transfer account for your business only takes a few minutes. You just have to enter some details about yourself and your business. Your account may need to be checked before making any transfers or providing balance details. Since 2011, Wise Transfer has helped more than 4 million people and businesses send money to more than 70 countries

14 times cheaper than PayPal

Banks and services like PayPal usually set their own unfriendly exchange rates. This means that you pay more than you need when you send, charge or receive international money. And they pocket the difference. In Transfer Wise, they never specify the exchange rate. You will always get real exchange rates in the market – like what you find in independent sources like Google, XE, Yahoo Finance or Reuters. Customers now save more than 3 3 million more per day than other wireless currency transfer services

EPI lets you connect your account with your trading tools. This means you can make payments and workflows automatically. So you can build whatever you need to do business better. Transfer Wise also works with your favorite Zero and accounting tools. To automatically sync your activity, you can connect your accounts and sync your accounting.

How much does it cost to send a wire transfer with Wise Transfer?

Shipping costs depend on three things – the amount you send, the payment method and the exchange rate. The more money you send, the more money you transfer. This is because the Wise transfer fee is paid on the currency transfer wire as a percentage of the amount you send. The percentage varies from currency to currency and you can check it on the pricing page. The exception to this is that if you send a small amount of money, then the minimum cost is low

How you pay There are different ways to pay depending on the country you are sending money from. When setting up your transfer, you will see how much each payment method or type of transfer costs. Exchange rate, you always get the middle market rate – this is the bank rate they use to trade between themselves. Because we never increase this rate, your recipient will get more money

The exchange rate in the middle market is always moving. So for some of our currencies, you can lock in the rate you see when you set up your transfer – and guarantee it until we get the full amount within the stated timeframe (typically 24 or 48 hours). Get

in the end

If about what is a currency transfer wire. Is wire transfer a way to transfer international money? Is wire transfer the best way to transfer currency between different countries in the world? And if you have other questions, you can ask them through the contact link on our website